In the whirlwind of life’s daily grind, it’s easy to lose track of the small things—like those recurring subscription charges on your credit card. For me, this realization came when I lost my job and started combing through my expenses to find ways to cut back. That’s when I noticed a charge for Fun Rewards+, a service I had signed up for while employed but had completely forgotten about.

For three months, I had been paying approximately $16 a month without ever using the service. My first instinct? Cancel it immediately. But curiosity got the better of me, and instead of canceling, I decided to explore what Fun Rewards+ actually offered.

What is Fun Rewards+?

Fun Rewards+ is a cashback and rebate service that partners with many major retailers. Members can earn cashback on purchases and even receive free shipping rebates on qualifying transactions. With rising costs everywhere, these benefits can add up quickly, especially if you’re shopping online or making frequent purchases.

Following the Rules Pays Off

Once I decided to give Fun Rewards+ a shot, I learned that you do need to follow their rules when submitting receipts. To qualify for cashback or shipping rebates:

- You must submit a full receipt with all products clearly shown.

- The receipt must be submitted within 60 days of the purchase.

- You have to manually input the subtotal minus any discounts and taxes.

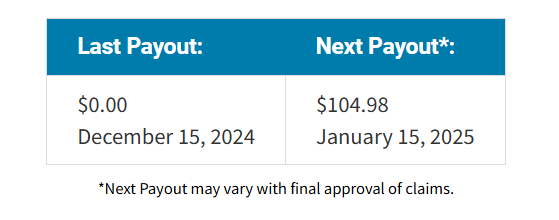

Thankfully, I had been keeping my receipts, and I was able to upload ones from stores like Target, Walmart, Etsy, eBay, and others. To my surprise, the process was straightforward, and I ended up receiving over $100 in cashback for purchases I had already made.

Why I Kept the Service

Initially, it felt counterintuitive to continue paying for a service when I was actively trying to cut costs. However, once I started using Fun Rewards+, I quickly realized that it could help me save money on things I actually needed to buy. The cashback alone began offsetting the $16 monthly fee, and the shipping rebates were a game-changer for those unexpected purchases.

Cashback services like Fun Rewards+ are a smart idea if you actively use them, but they’re especially helpful during unemployment, when every dollar matters. With a little effort, I was able to stretch my budget further, which made a significant difference during a challenging time.

Now, instead of seeing Fun Rewards+ as just another charge on my credit card, I view it as a tool that helps stretch my budget further. Losing my job forced me to reassess my finances, and Fun Rewards+ ended up being an unexpected bright spot.

If you’re looking to make the most of your spending, whether employed or between jobs, Fun Rewards+ is worth exploring. It might just turn out to be the financial hack you didn’t know you needed.